Allovue is company that helps education leaders manage their finances and make budgeting decisions. Balance is their financial software platform designed to help K-12 school district leadership budget, manage, and evaluate their financial data. An enormous part of how a child’s education turns out is based on how money is spent and allocated in schools during that child’s education, and Allovue strives to make sure education leaders have all the information they could possibly need to make equitable financial decisions. In short, Allovue is designed to help education leaders become effective financial managers and engage them in school finance by actively connecting them to the budgeting and spending process.

To be clear, this is not a product that will be used by K-12 classroom teachers, but rather it is a solution to be used by location and district leaders to effectively budget and manage balanced financial decision making.

Overall, Allovue is designed with every aspect of K-12 financial management in mind. You can create budgets, manage them collaboratively, and keep track of every type of data point you might need.

Although my experience dealing with school budgeting is somewhat limited to the perspective of technology services, I strongly believe that Allovue offers an excellent district-wide solution for managing and tracking finances. From what I have seen in K-12 education, many of our budgeting protocols and services are out-of-date, tedious, and not connected across entire districts. I think Allovue offers a solution that can greatly help schools and leaders make some of the most important decisions they have to make, ensuring that school dollars are being utilized in ways that actually benefit teachers and students in the classroom.

As a product suite, Allovue is focused on helping districts do three things to keep their finances in balance:

1) Manage (to track spending throughout the school year)

2) Budget (to plan spending for the next school year) and

3) Evaluate (reviewing data to recognize patterns and find solutions).

We’ll first take a look at Allovue’s Balance Manage, which focuses on monitoring and reviewing spending information for your current school year’s budget.

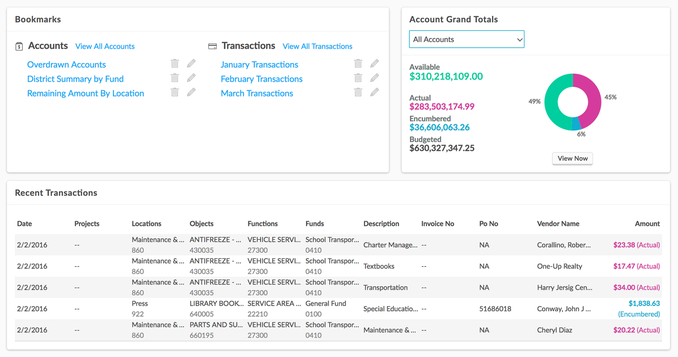

When you first log in, you’re taken to your home dashboard where you can see your account grand totals, all recent transactions, and any bookmarks you’ve added (we’ll get to those in detail in a moment). In short, this page offers a big picture overview of the financial status of your district.

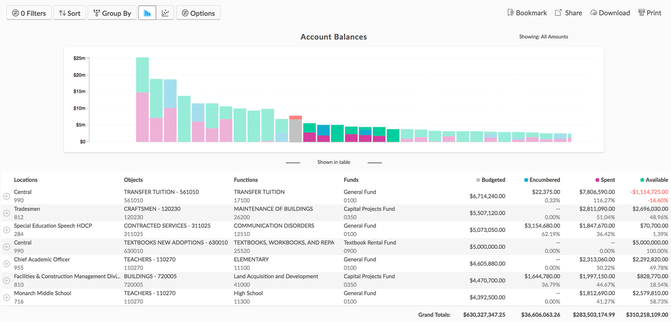

If you head over to the Accounts page, this is where you can get an incredibly detailed breakdown of each account, and how the money that has been allocated for that account is (or isn’t) being spent. At the top of the page you’ve got a bar graph, displaying the available, actual, and encumbered (i.e. money that has already been promised out) spending for each account. Below that, you can see your individual accounts with their specific details:

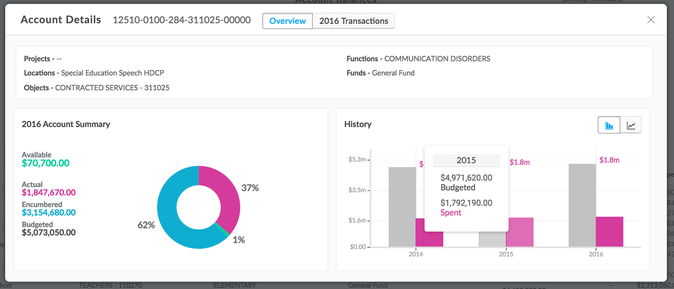

Clicking on an individual account line will give you a detailed overview of that account’s segment codes, spending, transactions, and (provided you have information in the system from previous years) you can also get a historical spending comparison that allows you to see where you’re at in the current year, compared to years past. Since the application suite is designed to work with your school’s current chart of accounts, all of the data points you already track and monitor for spending throughout the school year are captured.

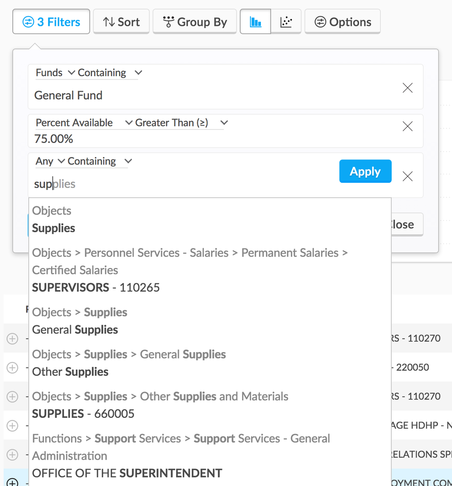

This becomes very important when you begin to use filters, at the top left corner of the accounts page. Filters are useful in narrowing down the list of accounts you are viewing based on segments from your chart of accounts (e.g. Location, Fund, Object, etc). You can stack filters to get incredibly precise and narrow your account results to a few or many specific accounts, you can group those accounts by your segment codes, and you can also bookmark your filters so that you can easily see them on your dashboard, or share them out with colleagues who may need access.

Using filters and grouping and bookmarks you can make it incredibly easy to regularly check up on the accounts that concern you, compare financials across locations or funds.

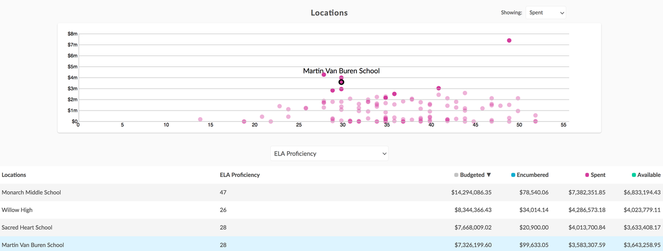

In this view, there are display options to show or hide segments and codes, to sort, and to print or download (to CSV or Excel) your financial data. The scatterplot button at the top of the page will allow you to compare your financial data across other points of interest.

For example, if you also have enrollment or attendance data in the system you can plot that against spending to spot patterns or troubling outliers, or you can compare spending to proficiency and test scores to identify schools which are doing more with less or who need more money to succeed.

This kind of evaluation of the data puts district level finance leaders in the position to identify and repeat successes, and spot and correct troubling trends throughout the school year, rather than at the end of the fiscal year when it’s too late to make changes.

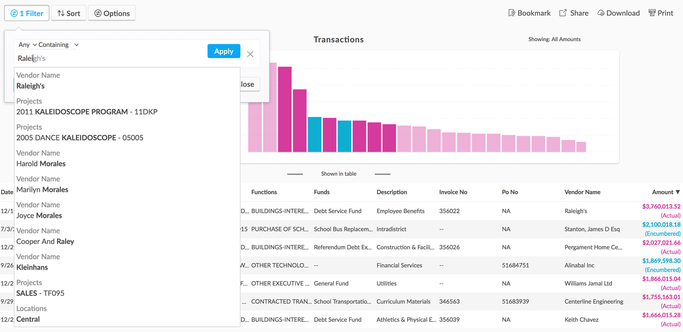

Moving on to the Transactions page within Manage, there are a lot of similarities, except instead of looking at the big picture accounts, you’re looking at individual actual and encumbered transactions. This transaction data is updated nightly, putting school leaders in the position to effectively manage spending in real time rather than having to wait for up to date account balances.

All the control and segments you had within the Accounts page still exist, just at the micro level for each transaction. You can group, share, download, and print, just like before and when you filter transactions you’ll notice the addition of transaction specific fields like vendor name, PO number and invoice number.

That covers the basics of managing a district’s spending during the fiscal year, next, let’s take a look at how one is created for the upcoming school year using Allovue’s Balance Budget tool. In general, Balance Budget is split between the role of budget architects (those who create the budgets, typically at the district level) and budget builders (those who decide how the money will be spent at the more granular level, typically principals, technology leaders, department heads, etc.)

Creating a new budget is just as straightforward as managing a current one. The Allovue team has done an exceptional job creating a system that is incredibly user friendly, and certainly beats the system of passing spreadsheets back and forth through email that my technology department used at my previous school.

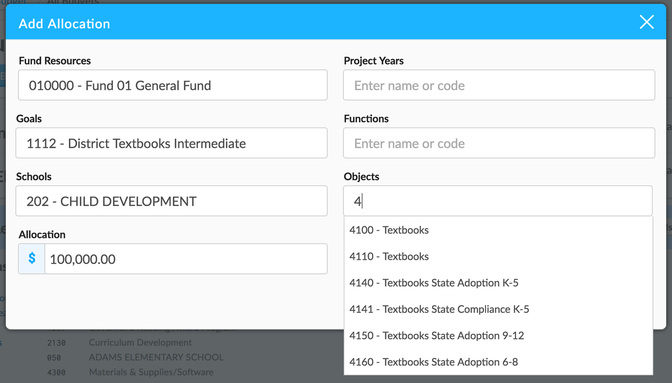

After giving the budget a title you create Allocations so that there is money in the budget to be planned. An allocation is a set of dollars that is reserved for some kind of specific spending (like a fund, or textbooks, or staffing at a location). Just like before, the fields you complete to create an allocation are completely tailored to your district’s chart of accounts. More importantly, as you choose a single code for each of these segments, you are limiting the codes that can be used when your budget builders are adding planned expenses there. For example, if the funds are limited to the object code for textbooks, they can’t be spent on staffing.

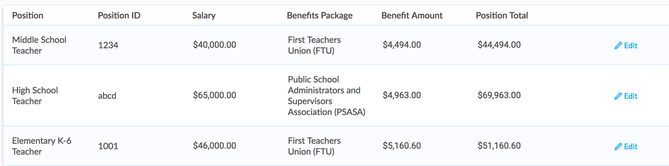

To get ready for your builders to add planned expenses to their budgets the Architect will create positions (e.g. science teacher) and benefits (e.g. health insurance or 401k) that determine the personnel expenses that your budget builders can create. Just like with everything else, these are completely customized to your district’s chart of accounts and how your district budgets for salaries (actual or average).

The nice thing here is, if you update a salary or benefits package, it will automatically be pushed out to your budgets and across any accounts where those items are used. I haven’t seen this feature in any other K-12 financial service, and I think it would be an enormous time saver.

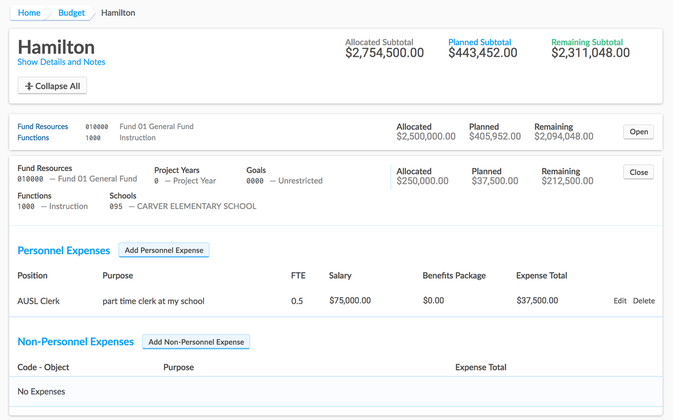

Finally, once the budget architect has completed constructing the overall budget across the district, they can then assign it to one or many budget builders who can begin making specific decisions about how each allocation is going to be spent and adding planned expenses. Builders have a similar experience when they log into Balance Budget, but instead of creating allocations and budgets, builders are adding planned expenses to the budgets.

As a builder, you are able to add in both personnel and non personnel expenses. This allows the builders to have control over how allocations are being spent and broken down within their school or department. The architect sets up the budget outline, and the builder gets to specify how all those personnel and non personnel expenses get spent. If your district doesn’t allow as much autonomy in spending, architects can also add expenses and leave the budget builders to complete lower level budget planning.

In short, if you’re looking for an excellent system to manage and track school spending, I absolutely recommend contacting Allovue to setup a demo and see if they are a good fit for your district’s needs.

The opinions expressed in this review are my own.

I was not compensated for writing this review.